Your Credit Score Shouldn’t Hold You Back.

Here’s How You Can Take Control.

Understanding Credit Score

In Canada, your credit score is a three-digit number, typically ranging from 300 to 900, that represents your creditworthiness based on your financial history.

It is seen as a key indicator of your financial health and plays a major role in many of life’s big decisions. Lenders use your credit score to assess how responsible you are with managing credit, and those with no or bad credit might be locked out of the traditional car lending market.

While understanding how your credit score is calculated, what impacts it, and how to improve it can empower you to make smarter financial choices, we also know that not everyone has a perfect credit history. At BC First Nations Financing, we believe that bad and limited credit histories should not stop ANYONE from getting reliable transportation. Therefore, we help individuals with less-than-perfect credit scores secure the financing they need to get back on the road and move forward with confidence. Apply for pre-approval for a car loan with us today to get your dream car and start building your credit.

Understanding Credit Score

Poor (300–559)

High risk due to missed payments or defaults. Limited loans with very high rates.

Fair (560–659)

Moderate risk; qualifies for some loans but with higher rates and fewer options.

Good (660–724)

Reliable credit; access to better loan terms and reasonable interest rates.

Very Good (725–900)

Low risk; eligible for the best financial products and lowest interest rates.

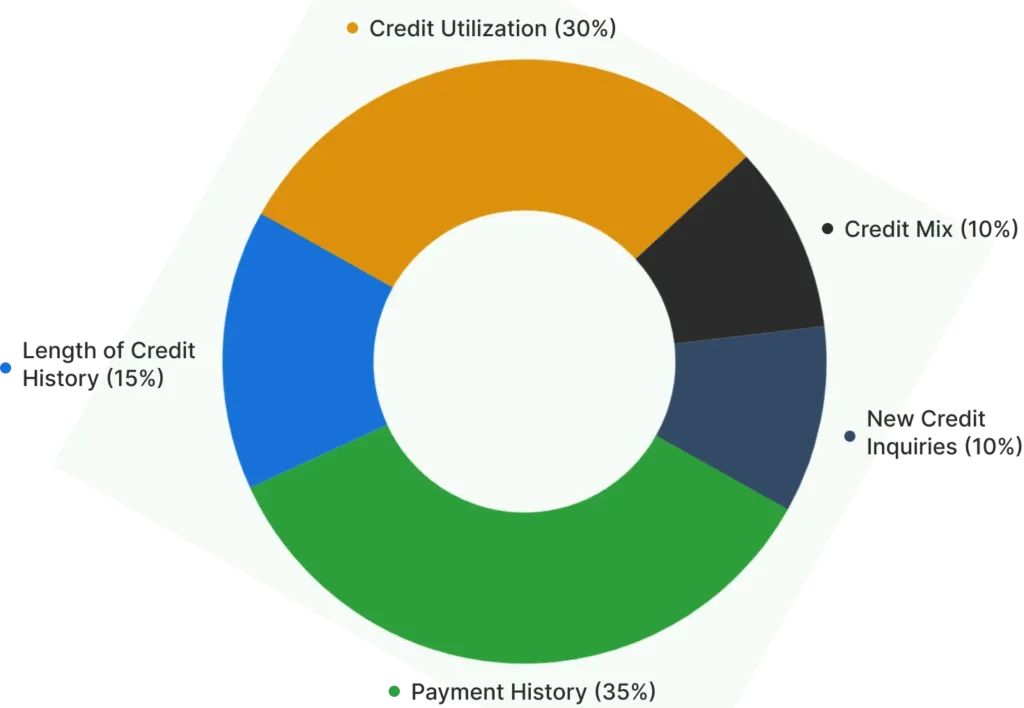

Factors That Affect Ones Credit Score

- Payment History: Timely bill payments improve your score.

- Credit Utilization: Keeping balances low relative to your limit is crucial.

- Length of Credit History: Older accounts positively impact your score.

- Credit Mix: Diverse types of credit accounts (loans, cards) help.

- New Credit Applications: Frequently applying for things like new credit cards can lower your score. However, applying for pre-approval will not have an impact.

Factors Affecting Credit Score

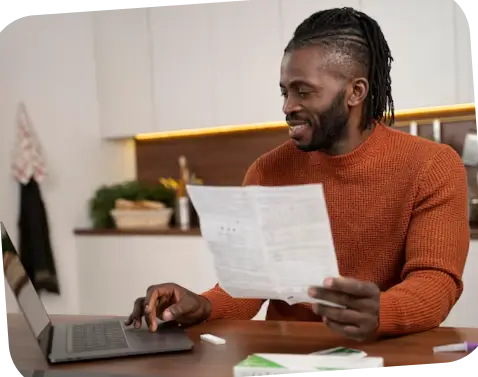

How to Improve Your Credit Score

Pay Bills on Time

Timely payments are the backbone of a healthy credit score. Automate your payments or set reminders to stay on track.

Monitor Your Credit Report

Check your credit report regularly for errors that might hurt your score. Correcting mistakes can boost your credit profile.

Lower Your Credit Utilization

Whether you’re in a major city or a remote area, we’re committed to helping clients across all of British Columbia.

Settle Outstanding Debts

Prioritize paying off debts with high interest rates first. This lowers your debt-to-income ratio and improves your score.

Use Credit Wisely

Consider tools like secured credit cards or credit builder loans to demonstrate positive repayment habits.

Avoid Excess Credit Applications

Multiple credit applications can lower your score temporarily. Research before applying and choose wisely.

Car Loans and Your Credit Score

A car loan isn’t just about financing your vehicle—it’s an opportunity to strengthen your credit profile when managed responsibly. Here’s how it works:

- Builds a Positive Payment History: Your payment history is the most important factor in your credit score, accounting for 35%. Making on-time monthly payments for your car loan demonstrates financial reliability, which can significantly boost your credit score over time.

- Diversifies Your Credit Mix: Having a variety of credit types, such as a car loan alongside credit cards, positively impacts your credit score. This mix shows lenders you can manage different forms of debt responsibly.

- Establishes Credit for New Borrowers: For those new to credit, a car loan is a great way to build a strong credit profile. Paying off the loan consistently demonstrates responsibility and earns lender trust for future financial opportunities.

- Balances Credit Utilization: Though car loans are installment debts, they contribute to a balanced credit profile. This can offset high credit card usage and improve your overall creditworthiness in the eyes of lenders.

Your Credit Questions, Answered!

Does applying for pre-approval affect my credit score?

No, applying for pre-approval with BC First Nations Financing will absolutely not affect your credit score! It’s quick, simple, and safe.

How long does the approval process take?

Our approval process is designed to be quick and hassle-free. In most cases, we can provide a decision within 24 hours. Once approved, we work with you to finalize your financing and help you get on the road as soon as possible.

What types of vehicles can I finance?

We offer financing options for a wide range of vehicles, including cars, trucks, SUVs, vans and everything in between. Whether you’re looking for a reliable family car or a rugged truck, we’ll help you find the right vehicle to meet your needs and budget.

Is my personal information secure?

Yes, your personal information is completely secure with us. We use industry-standard encryption and follow strict privacy protocols to ensure your data is protected at all times. Your trust is our top priority.

Can financing improve my credit score?

Yes, financing a vehicle through us gives you an opportunity to improve your credit score. Consistently meeting your payment obligations demonstrates financial responsibility, which can have a positive impact on your credit profile over time.

Do you really include a free vehicle delivery to remote BC locations?

Yes, we offer free vehicle delivery to remote locations throughout British Columbia. We understand that access to transportation can be challenging in certain areas, and we’re committed to making the process convenient and stress-free for all our customers.

Auto Loan Calculator

You Are One Step Away From Your Dream Car

Join over 10,000 satisfied clients who trust BC First Nations Financing for their Auto Loan